Optimal Models to Fund Your Employee Benefits: The Pros & Cons of Five Options

Purchasing health insurance for employees varies significantly based on a credit union’s size and risk appetite. This white paper identifies five different funding models credit unions should consider and outlines the pros and cons of each.

-

Fully-Insured

-

Self-Funded (aka Self-Insured)

-

Level-Funded

-

Association Health Plans

-

Insurance Captives

Typically, small to mid-sized credit unions purchase and provide health insurance that covers claims and related expenses using a fully-insured model while larger credit unions can utilize a self-funded methodology. Depending on location, risk appetite, broker capabilities, and carrier flexibility, credit unions can also explore hybrid options such as level-funding, association health plans, and insurance captives.

Fully-Insured Plans

Fully-insured insurance plans are structured such that a credit union purchases healthcare coverage from an insurance provider for a predetermined, per-employee premium. The insurance company undertakes the risk that employees will utilize their healthcare services; therefore, it proportionately pays for those services according to the purchased plan(s).

Insurance premium rates are fixed and in effect for a one-year period and are dependent on how many employees are enrolled in the plan each month. Fully-insured plans require the insurance carrier to collect the premiums and pay for any filed claims. Enrolled employees within the coverage plan will pay predetermined deductibles and any co-pay portion as determined by the insurance plan.

The limited and perceived benefits of a fully-insured medical insurance plan is the low volatility of fixed premium costs for the employer within the 12-month plan.

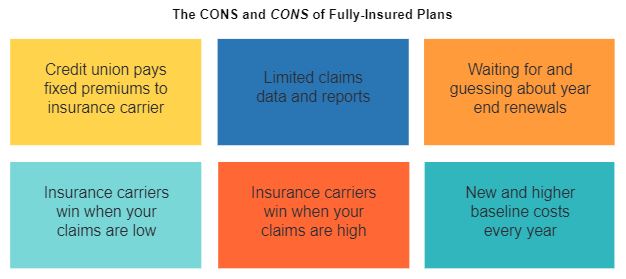

The downside to fully-insured plans is plentiful, including a general lack of transparency; meaning the carriers provide very limited claims data and reports. Additionally, insurance carriers often wait until the very end of a plan year before releasing the coming plan year’s price quote, leaving credit unions guessing what their renewed rates will be and potentially upsetting their budgets.

Fully-insured plans also have the negative connotation that the carrier always ‘wins,’ regardless of whether claims are high or low during a given plan year. When employee claims are lower than expected in the plan year, the insurance carrier wins because the credit union overpaid for premiums. When employee claims are higher than expected in the plan year, the insurance carrier wins because the credit union is presented with significantly higher premiums the following year. Each year the baseline cost gets reset higher and it rarely, if ever, goes down.

Fully-insured plans are much more advantageous for the insurance carrier than the employer.

Self-Funded Plans

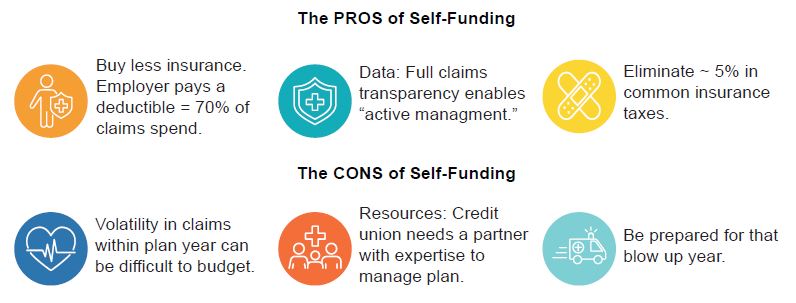

Self-funded healthcare is a strategy to self-insure some of the more routine claim expenses using the credit union's operating funds, rather than paying an excess amount to an insurance provider. Self-funding removes the more common or predictable claims activity from what the insurance carrier normally pays in a fully-insured plan.

Above the layer of self-funding plan money that the credit union has budgeted for, there is a need to pay for stop-loss insurance, or catastrophic insurance, a form of reinsurance that further insures self-funded plans and other credit union assets to avoid extreme loss or bankruptcy. Third-party administrators (TPA) are used to distribute the claims payments that the employer pays.

There is much more transparency in a self-funded plan, as all claims funnel through the credit union, and more management decisions can be made to control expenses. Employers also experience approximately 5% reduction in common insurance-related tax obligations.

Level-Funded Plans

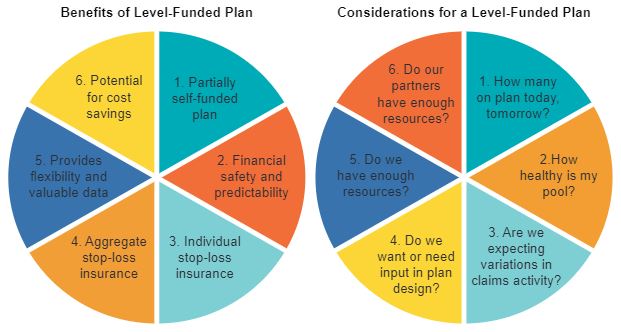

A level-funded healthcare plan is similar to a self-funded plan, but on a more limited basis. Level-funded insurance plans combine the potential cost savings and flexibility of a self-funded plan with the financial stability and predictability of a fully-insured plan. Self-insured plans place more risk on the credit union, but they also have the potential for greater cost savings. As such, there is a steady and noticeable increase in level-funded usage within the insurance industry.

Level-funded health plans administrative costs are fixed, charged on a per-employee basis, and will not change within the plan year regardless of the number of claims filed. There is also a component of aggregate stop loss coverage for the combined employer workforce. When the group’s aggregate stop loss or an employee’s specific stop loss limit has been reached, the stop-loss reinsurance kicks-in to pay the remainder of the claim. As claims go, this is considered the variable piece of level-funded health plans and represents the largest cost savings component.

As in a fully-funded plan, insurance carriers tend to increase the estimated cost that a credit union’s group policy will charge for the year. That sum is divided by the total number of employees to calculate each employee’s total premium, before it is split between the employer and the employee. The very notable key difference in a level-funded health plan now occurs when the filed claims turn out to be lower than originally estimated, requiring the insurance company to refund some, or all, of the unused funds back to the employer.

Level-funding is typically described as a partially self-funded plan.

Association Health Plans

Association health plans (AHP) allow small employers with common interests to form an association and expand access to more affordable health coverage for all individuals within the association. AHP collaborative plans make it easier for smaller employers to band together and be recognized by insurance providers as a singular pooled entity, thus affording them "large company” discounted rates and even more health insurance plan options for their participants.

Washington D.C. based healthcare research firm, Avalere Health Company, recently projected that AHP premiums will experience meaningful savings advantages versus alternative, more conventional insurance options. They have predicted that AHP premiums will be “between $1,900 to $4,100 lower than the yearly premiums in the small group market and $8,700 to $10,800 lower than the yearly premiums in the individual market by 2022.”

The Pros of Association Health Plans are:

-

AHPs leverage the collective group’s buying power to better negotiate insurance costs and healthcare provider reimbursements compared to smaller single credit unions that have very limited leverage dealing with insurance carriers.

-

An AHP often provides enhanced HR administrative tools and resources normally reserved for larger organizations.

-

If AHPs opt to use self-funding for the group’s health insurance needs, the association can gain access to medical claims data which helps to identify and resolve payment issues and reveals which providers charge more for the same services.

-

AHPs are not restricted by government exchange insurance requirements and, therefore, can design benefits tailored to specific employee needs, rather than being mandated to a one-size-fits-all plan solution. AHPs are more flexible than those within the ACA coverage offerings.

The challenges of Association Health Plans are:

-

Some states do not allow for collaborative health solutions like AHPs, Trusts, or other Multiple Welfare Employer Arrangements (MEWA).

-

Some insurance carriers are not friendly to AHPs, especially if the carrier is the dominant provider in a specific state.

-

AHPs require collaboration between credit unions in a geographic area, but also need key stakeholders to build, implement, and maintain the success of the program. Look to CUSOs, leagues, and associations for assistance.

Insurance Captives

An insurance captive is an insurance company that is wholly owned and licensed by the credit unions that are insured by it (its owners). Captive insurance is a collaborative approach to group self-funding. Captives provide the benefits of self-funding while also providing an added layer of insurance protection to help mitigate the risk of a high claims plan year. Credit unions participating in a captive have access to more detailed data reporting, can lower their tax burden, control, or cap their entire health insurance spend amount and reap long-term savings and investment benefits collaboratively.

Features of a credit union managed insurance captive:

-

Self-funding a portion of your employees’ medical insurance claims means each participating credit union is buying less insurance, compared to a fully-funded plan.

-

Depositing collateral monies through an insurance captive means credit unions are again buying less insurance from the carrier. The pooled money invested in an insurance captive is used to fund high-cost insurance claims.

-

Purchasing stop-loss insurance as a larger pool means credit unions are paying less for insurance and buying less of it. The need for stop-loss insurance is mitigated in two different ways:

-

Each credit union is self-funding a portion of their employees’ claims before stop-loss insurance is needed.

-

High-cost claims are funded through the captive before stop-loss insurance is needed.

These two insurance layers kick-in to fund claims before a credit union utilizes any stop-loss insurance. Plus, when stop-loss insurance is needed, it is pre-purchased at a lower rate because of the large group’s negotiating power.

-

Any unused captive funds can be shared back to the credit unions each year. Finally, a solution where credit unions are rewarded for their employees’ health and wellness!

Best of all, an insurance captive can be exclusive to credit unions. Healthy, like-minded groups that are working together to deliver their employees the best benefits available.

Understand Your Risks

The key benefit of a stop-loss captive is the possibility of savings over the long term. Employers need to understand, however, that savings are not guaranteed from year to year. For example, on average, a captive may lose money in one out of four or five years. During these down periods, captive members may be required to put in additional capital to cover the loss. After all, captive members face the possibility of an adverse claims event that exhausts most or all the captive’s capital. In a worst-case situation, full recapitalization could be required in the subsequent year. Therefore, a commitment to a captive requires leadership’s commitment to a long-term view.

To begin evaluating the appropriateness of a stop-loss captive, ask yourself these questions. Does your organization have:

-

A long-term financial view?

-

Committed leadership?

-

An understanding of the risk/reward and complexity/savings trade-off? In other words, is the view worth the climb?

-

Comfort with the stability and capitalization of the captive? An understanding of the underlying risk (both yours and that of the other members of the captive)?

-

The ability to post collateral?

If you can answer “yes” to each of these questions, it makes sense to proceed with a thorough evaluation.

Find a Trusted Partner

Captives work for some employers, but not for others. How can you be certain that you are making the right decision for your organization? The key to the decision is an understanding of your organization’s risk and the captive’s risk— including insight into large-claims risk for all members of the captive. It is also important to ensure that the captive will be worth the effort, which means considering different scenarios that realistically show how your potential pooled layer might yield savings over time. InterLutions can help you look beyond the surface to carefully evaluate your options.

Download the White Paper