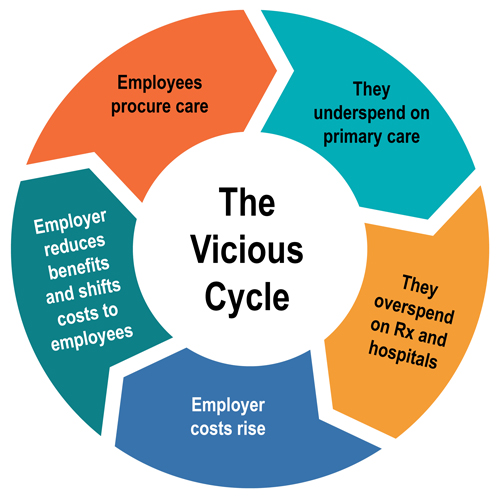

The Vicious Cycle of Health Insurance Renewals

Maybe it’s time we actually do something different?

If you’re still purchasing medical insurance the old way – meaning one year at a time with the same broker, carrier, and fully-insured model – you’re sailing straight into stormy weather as healthcare costs rise and catastrophic claims hit with greater frequency and severity.

Don’t fall into the 12-month trap and vicious cycle of fully-insured health plans. Change your course. Make self-insurance – without the risk and volatility – a reality with I-Care.

The Guiding Principles of I-Care:

-

Reduce the year-to-year volatility and risk of self-funding

-

Transition from the broken fully-insured plans

-

Provide tools to reduce the cost of healthcare

-

Deliver data to reveal hidden opportunities to reduce medical and pharmacy claims costs

Who is a "good fit" for I-Care?

-

Fully insured credit unions that are fed up with renewal increases with limited data

-

Self-funded credit unions that are tired of volatility

-

Credit unions with 20-1,000 employees

-

Credit unions looking for a solution to help control costs

-

Credit unions that require buy-in from both HR and the executive team

-

Credit unions that are open to working with a third-party administrator (TPA), not a major medical carrier

-

Organizations interested in using data to guide programming and reduce claims risk

Call us today for a free evaluation at (414) 433-0174.