Insurance Captives: Are They Right for Your Credit Union?

A stop-loss captive is a risk management practice that has long been used to manage costs and reduce employee benefit expenses. Credit unions are beginning to consider whether an insurance captive is an appropriate risk management tool for their medical plans. After all, it is possible for a stop-loss captive to offer these types of benefits:

-

Improved control over risk portfolio

-

Lower insurance expenses

-

Better cash flow

With potential benefits like these on the line, you might wonder why you would not want to participate in a captive. However, stop-loss captives require thoughtful evaluation. Two companies can have very similar profiles on the surface, but when you dig deeper, you may find secondary differences that could make or break a group captive solution.

If the question is whether a stop-loss captive is right for your credit union, the answer is a qualified maybe. Read on to learn about items you should consider before deciding whether to join a group stop-loss captive.

A Point of Clarification

In this paper, we offer a comparison between traditional self-funding and self-funding that incorporates a group captive. Our analysis assumes that the employer has already chosen to move to a self-funded solution and is now trying to determine which approach makes more sense — traditional self-funding or self-funding with a group captive.

Employers with fully insured medical benefi ts should conduct an entirely different evaluation to determine if some sort of self-funding solution is appropriate for their situations and corporate objectives.

How Does a Group Captive Work?

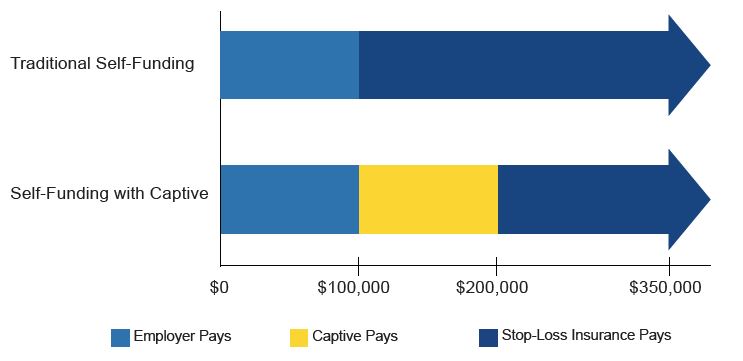

To illustrate the basics of a captive, let’s consider a single claim. This claim is filed by an individual who has a significant health event that costs $350,000.

With traditional self-funding, the employer might pay up to $100,000 of the claim before its stop-loss provider picks up the remaining $250,000. An employer with a self-funded plan that incorporates a group captive breaks down payment a bit differently. The employer pays up to $100,000 of the claim. The captive picks up the next $100,000, and the stop-loss carrier picks up the remaining $150,000. The money trail is slightly more complex than is illustrated in this graph, but the general concept is accurate.

Three Layers of Risk Management Via a Group Captive

Self-funding with a group captive relies on three layers of risk management. Within each layer, your organization will need to make plan-design decisions. The design that works best for you will be somewhat dependent on your organization’s tolerance for risk.

Here is a description of each layer and some of the decisions you will need to make:

-

Accepting the risk: This is the portion of claims (or risk) you will pay. You will self-fund this layer of your plan and cover claims up to the point where the captive kicks in. Typically, your risk within this layer will be more predictable (claims that are high frequency but low cost). It is important to note that within this segment of your risk management program, your fi nancial status will not be affected by any other captive members.

You may or may not choose your own plan design and administrative service organization (ASO), depending on the captive. You will have individual contracts with the ASO and stop-loss carrier. Your risk and reward based on claims experience will affect your bottom line but only up to the point where the captive kicks in — a point you will decide.

-

Pooling the risk: This is the portion of claims (or risk) the captive pays. Risk in this layer is less predictable for a single employer (claims that are moderate cost but lower frequency). To add stability, a group captive brings together self-funded employer members to share risks. The captive is owned and controlled by its members. Each member will pay cash to the captive to cover these types of expenses:

- Expected risks (claims)

- A risk margin, just in case risks are worse than expected

- “Sleep at night” (also known as aggregate stop-loss) insurance that limits the annual potential losses of the captive

- Administration costs for running the captive

- Traditional individual stop-loss costs to cover risks that extend beyond what the captive is designed to accept

Risks associated with the captive begin at the point where the captive kicks in to pay claims, and they end where traditional stop-loss insurance begins.

-

Transferring the risk: This is the portion of your claims (or risk) paid by your stop-loss carrier. The captive accepts risk only up to a predefined point. From there, it transfers the risk it was not designed to accept (claims that happen infrequently but have high cost) to a traditional stop-loss carrier. As part of the group captive, your organization will pay a premium to a stop-loss carrier to fully cover any claims amounts that exceed the risk accepted by the captive. If you have a stop-loss carrier and are not part of a small-group captive, both the risk and reward related to claims experience are absorbed entirely by the stop-loss carrier.

Uncover Savings Potential

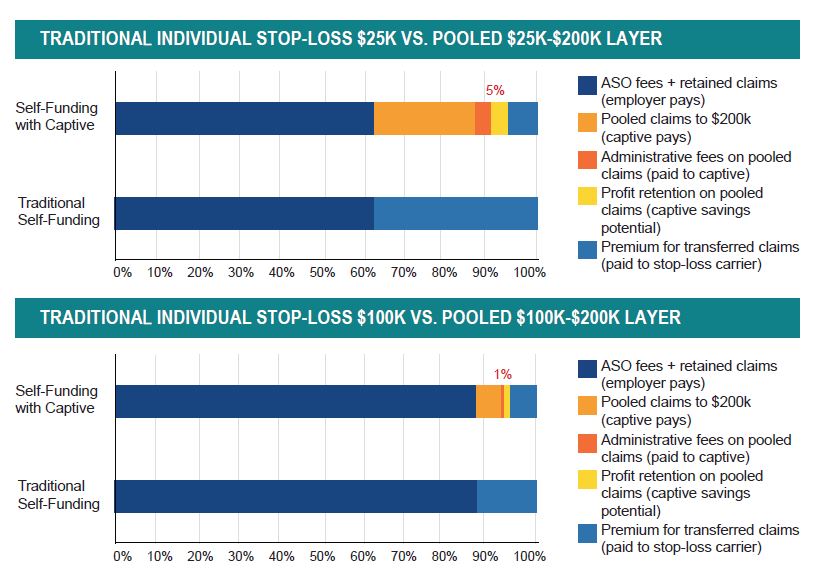

In a traditional self-funding model with no captive, an employer will pay the stop-loss carrier a fixed premium amount that covers the expected claims and administrative costs and provides some profit to the carrier. In contrast, with a group captive, the employer can enjoy savings on the part of the self-funded plan that is pooled with other employers because any profits (which actually are savings) remain in the captive.

It is important to understand, however, that if that pooled layer is too narrow, the savings potential is quite limited. For example, let’s say that costs associated with the pooled layer make up 10 percent of the overall spend. Of that 10 percent, let’s assume that the captive saves 10 percent associated with profit charges. That means the overall expected savings from the captive is only 1 percent, as compared to what an employer would experience with a traditional stop-loss approach. If that pooled layer is wider, like 50 percent of overall spend, then saving 10 percent of that 50 percent yields expected savings from the captive approach of 5 percent. Although the savings potential is higher, it is still important to evaluate the captive for appropriate capitalization, or funding, relative to the additional risk it assumes.

Other potential opportunities exist for savings in a captive approach. Often, the premium rates for the transferred layer (covered by a stop-loss provider) can be obtained at lower rates due to the group purchasing power of the captive’s members. Similarly, administrative fees can be lower if the captive requires all members to use the same claims administrator.

Understand Your Risks

The key benefit of a stop-loss captive is the possibility of savings over the long term. Employers need to understand, however, that savings are not guaranteed from year to year. For example, on average, a captive may lose money in one out of four or five years. During these down periods, captive members may be required to put in additional capital to cover the loss. After all, captive members face the possibility of an adverse claims event that exhausts most or all the captive’s capital. In a worst-case situation, full recapitalization could be required in the subsequent year. Therefore, a commitment to a captive requires leadership’s commitment to a long-term view.

As an incentive for keeping members in the captive (and to discourage members from jumping in or out or simply exiting early), some captives require payment of an early termination penalty. Such a penalty would make an early exit from the captive costly.

Start by Asking Some Questions

To begin evaluating the appropriateness of a stop-loss captive, ask yourself these questions. Does your organization have:

-

A long-term financial view?

-

Committed leadership?

-

An understanding of the risk/reward and complexity/savings trade-off? In other words, is the view worth the climb?

-

The willingness to accept the terms of the captive (ASO, wellness, consultant, extraction penalties)?

-

Comfort with the stability and capitalization of the captive? An understanding of the underlying risk (both yours and that of the other members of the captive)?

-

The ability to post collateral?

If you can answer “yes” to each of these questions, it makes sense to proceed with a thorough evaluation.

Find a Trusted Partner

Captives work for some employers but not for others. How can you be certain that you are making the right decision for your organization? The key to the decision is an understanding of your organization’s risk and the captive’s risk— including insight into large-claims risk for all members of the captive. Also important is ensuring that the captive will be worth the effort, which means considering different scenarios that realistically show how your potential pooled layer might yield savings over time. A partner like Lockton, with strong experience in risk finance, stop-loss coverage, actuarial services, and employee benefits, can help you look beyond the surface to carefully evaluate your options.

Download the White Paper